The Future of Housing Occupancy: Victoria Capital Region

Demographic Growth & Change

Over the past 17 years, the Victoria Capital Region has grown from 337,720 to 374,065 residents; the 36,345-person increase meant the region grew by eleven percent between 1996 and 2013. This relatively slow growth was the result of annual population growth rates that were weak though the late-1990s and into the early-2000s, punctuated by two years of population decline during this period. Faster growth characterized the following decade, with annual population growth increasing from 0.7 percent in 2006 to 1.6 percent in 2009, a 17-year high. Consistent with provincial trends, population growth slowed after 2009 to 0.2 percent in 2011, before increasing back to 0.9 percent in 2013.

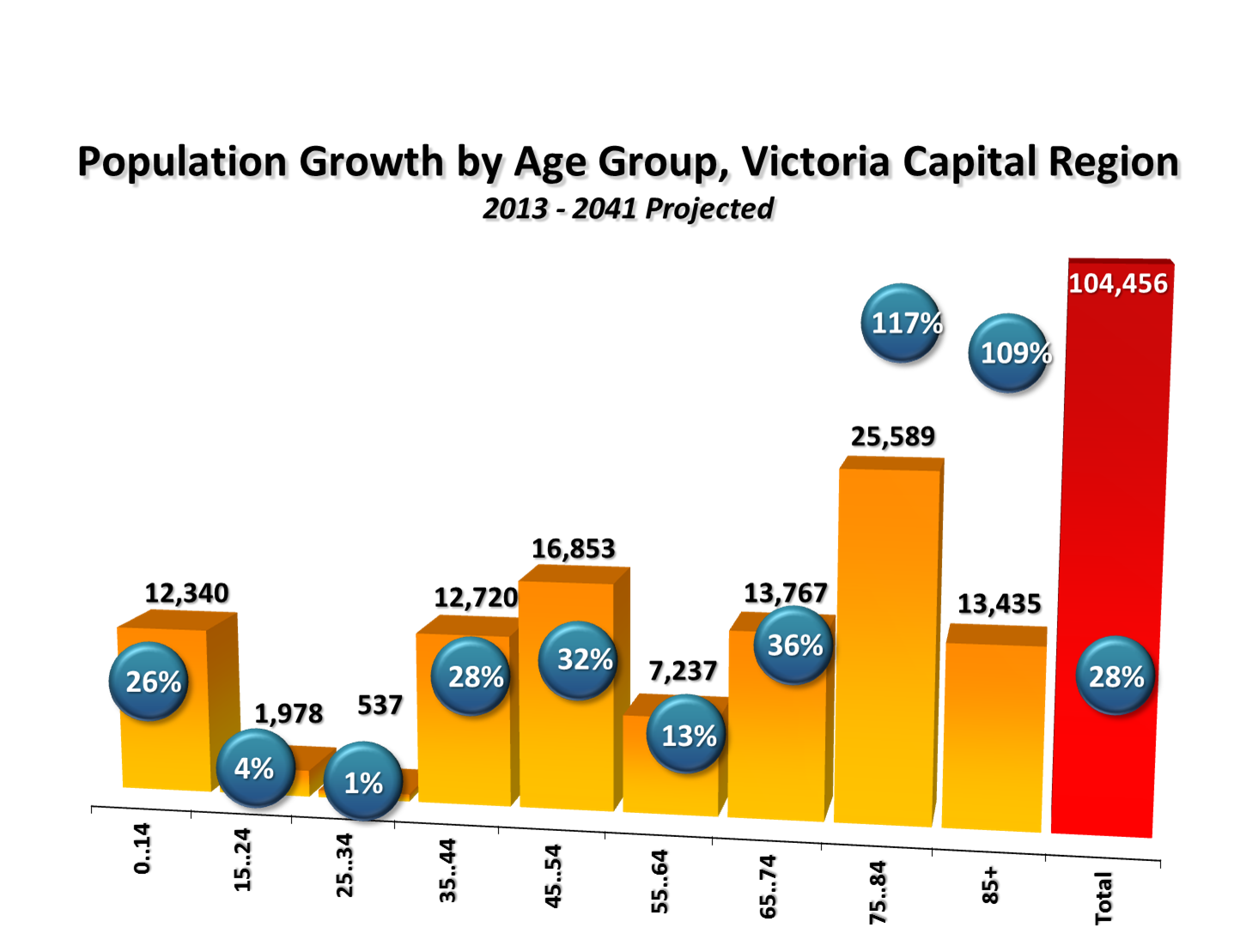

Accounting for the processes of aging, fertility, mortality, and migration, the Victoria Capital Region is projected to grow from its current 374,065 residents to just past 450,000 through early 2030 and further to 478,521 by 2041. As such, the coming 28 years would see the region’s population grow by 28 percent as it welcomes 104,456 new residents. In annual terms, population growth would increase into the range of one percent through the early-2020s before slowly trending down towards 0.5 percent by 2041.

In considering changes to the regional population’s age composition, as with other regions (and Canada as a whole) the greatest relative growth will be in the older age groups. More specifically, a 117 percent increase in the number of people aged 75 to 84 is projected for the 2013 to 2041 period, in addition to a 109 percent increase in the number of residents aged 85-plus, and above average growth of 36 percent projected for the 65 to 74 age group.

At the other end of the age spectrum, the 25 to 34 group is projected to grow by only one percent, the 15 to 24 group is projected to grow by only four percent, and the under-15 segment by 26 percent. Below-average growth is also projected for the 55 to 64 age group due to the aging of the baby boomers out of this age range and into the 65-plus cohorts in the coming decades. By 2033, 80 percent of the Victoria region’s current population is expected to be alive and potentially still living in the region, while 70 percent of today’s residents would still be alive by 2041.

Housing Occupancy Demand by Structure Type

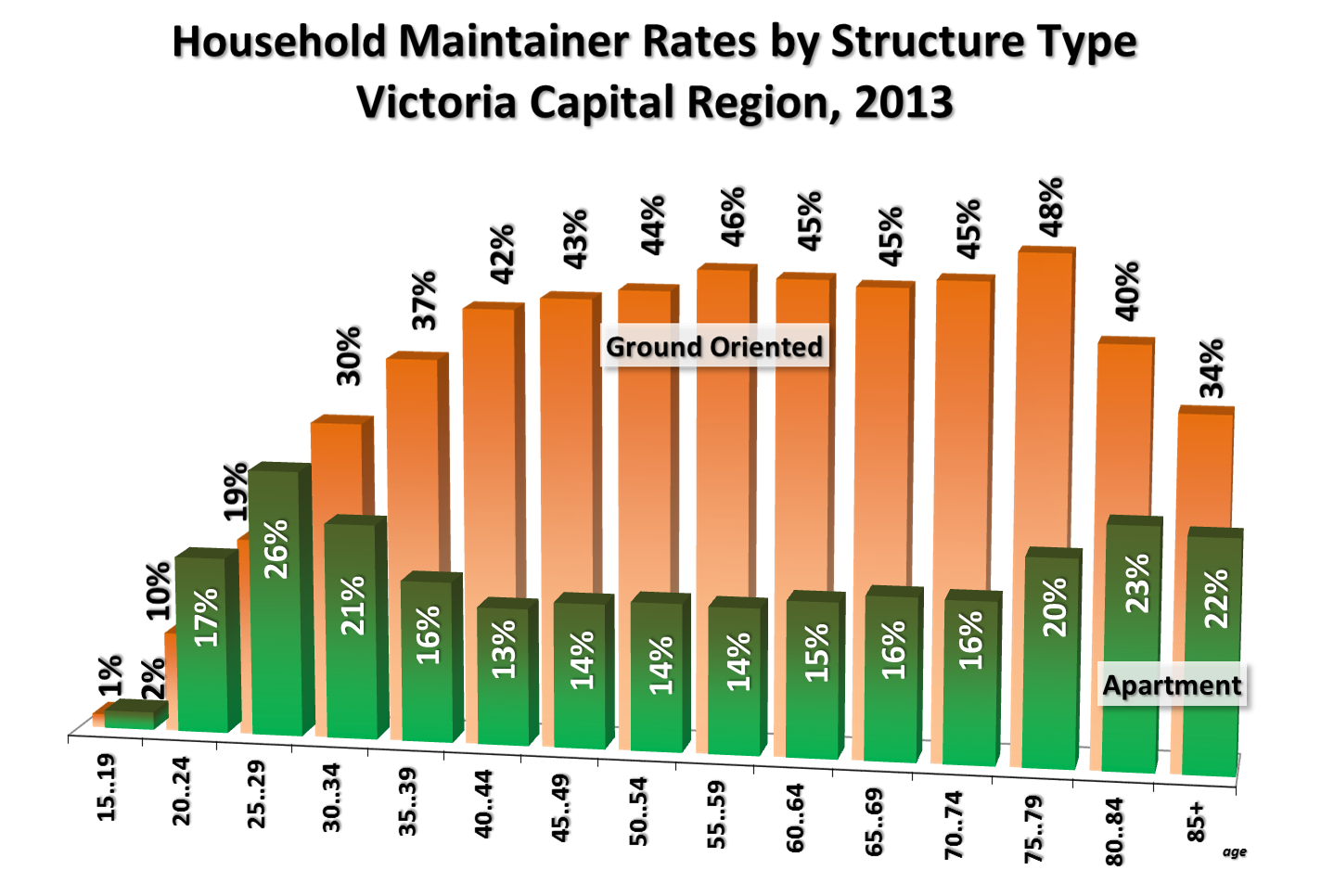

The patterns of regional housing occupancy as seen through the Census and National Household Survey show a distinct lifecycle pattern. Maintainer rates for both ground oriented and apartment housing rise with successive age groups from the youngest segment through the late-20s age group, where apartment rates peak at 26 percent (for 25 to 29 year olds). Ground oriented rates continue to climb from this age group onwards, peaking at 48 percent of people aged 75 to 79, before declining to 34 percent in the 85-plus group.

Apartment rates, on the other hand, decline to a low of between 13 and 14 percent for groups from their early-40s to late-50s. Apartment maintainer rates begin to increase in the late-60s, reaching 23 percent of residents aged 80 to 84 and 22 percent of those 85 and older in the Victoria Capital Region.

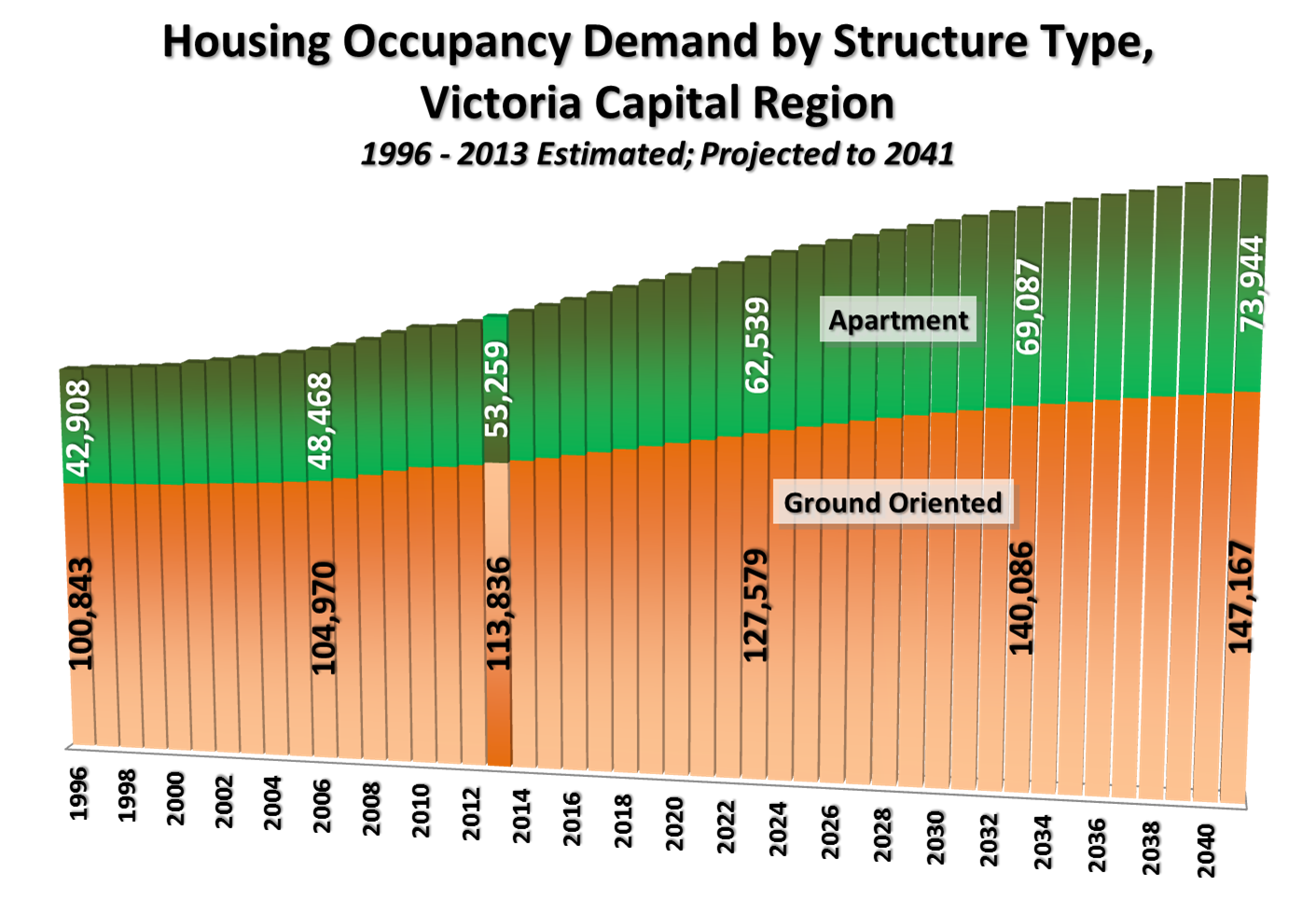

Combining trends in the lifecycle patterns of household maintainer rates with the pattern of demographic change projected for the Victoria region between 2013 and 2041 would result in household occupancy demand growing by 54,016 units over the next 28 years. High maintainer rates among the rapidly-growing older age groups would see the growth in total housing occupancy demand, at 32 percent, slightly exceed the projected growth for the region’s population (28 percent).

Additional housing occupancy demand will primarily be in ground oriented types of accommodation, with 33,331 net new ground oriented units required for to house the region’s 2041 projected population, while 20,685 net new apartments would also be required. The greatest relative growth would be in the apartment segment of the market, with apartment occupancy demand growing by 39 percent between 2013 and 2041 versus 29 percent for ground oriented units over the same period.

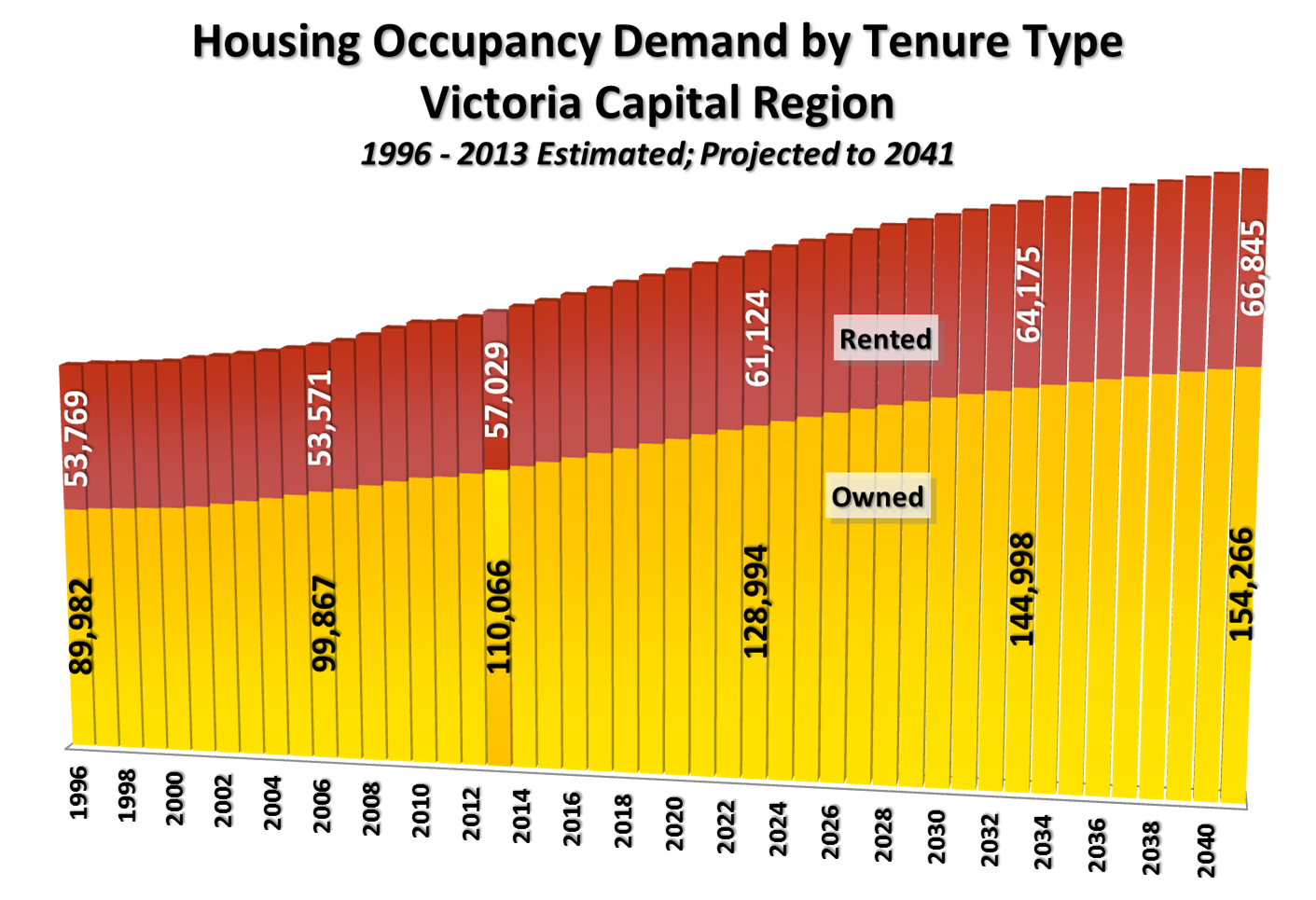

Housing Occupancy Demand by Tenure Type

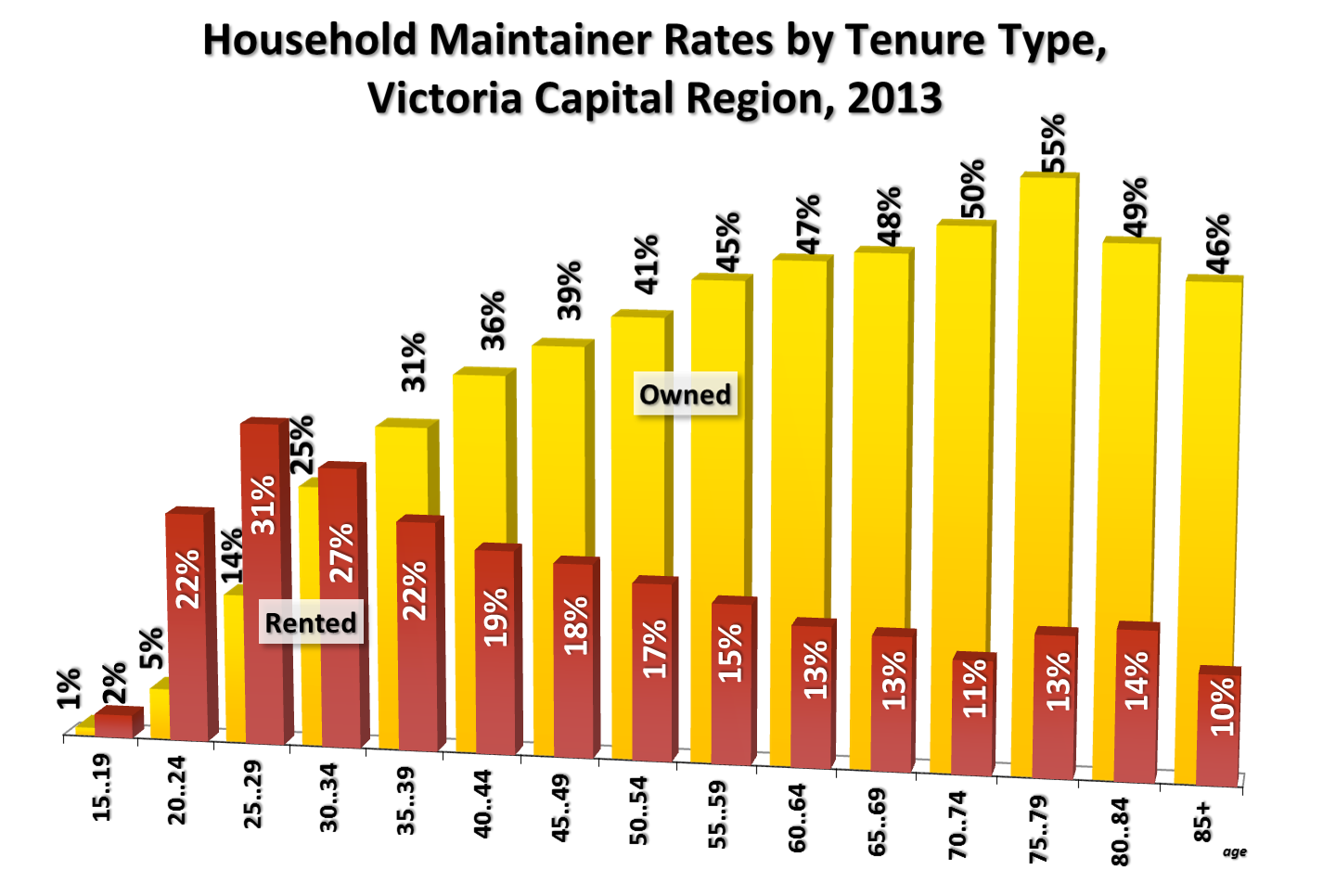

A distinct lifecycle pattern to maintaining a household also emerges when housing is considered on a tenure basis. In the Victoria Capital Region, owned maintainer rates increase significantly through the family formation and rearing stages of the lifecycle, going from a low of only one percent of people in the 15 to 19 age group owning their home to a peak of 55 percent for those aged 75 to 79. Although owned maintainer rates then decline to 49 percent and 46 percent for the 80 to 84 and 85-plus age groups, respectively, rates for owner occupancy among these age groups remain significantly higher than in most other metropolitan regions in Canada. Declining owned maintainer rates in the older age groups are consistent with moves away from owned dwellings, with people either moving in with their relatives, towards collective care facilities, or even selling their home in order to transition into the rental market.

With respect to the lifecycle pattern of rental maintainer rates, there is a significant increase in the post-secondary/labour force entry and early career/family-formation stages, with rental maintainer rates going from one percent in the 15 to 19 group to a peak of 31 percent in the 25 to 29 segment. Rates for this tenure type then decline to a low of eleven percent in the 70 to 74 age group. Increasing maintainer rates in the 75 to 84 age groups suggest that some people choose to transition from owning to renting in the latter stage of the lifecycle, with the decline in rental rates for the 85-plus population (when considered alongside the decline in owner-occupied rates) being indicative of a their transition out of private housing altogether.

Changes in people’s propensity to own or rent over the lifecycle, when combined with the projection of demographic change for the region, would see the future additional demand for owned units outnumber that for rented dwellings, both in relative and absolute terms. More specifically, the owned segment of the market would increase from 110,066 occupied units in 2013 to 154,266 by 2041; as such, demand for owner-occupancy is projected to grow by 44,201 net new units, or by 41 percent, between 2013 and 2041.

Future demand for rental accommodation is projected to rise from 57,029 units in 2013 to 66,845 in 2041, as an additional 9,816 rental dwellings would be required to house the Victoria region’s growing and changing population over the coming 28 years. In growing by 18 percent, the stock of occupied rental units would increase at a much slower pace than the 41 percent increase projected for owner-occupancy.

Click here to download a PDF version of a summary for Canada and selected CMAs, including this one.

Click here to download a PDF version of our full report.

© 2014 Urban Futures