The Future of Housing Occupancy: Edmonton CMA

Demographic Growth & Change

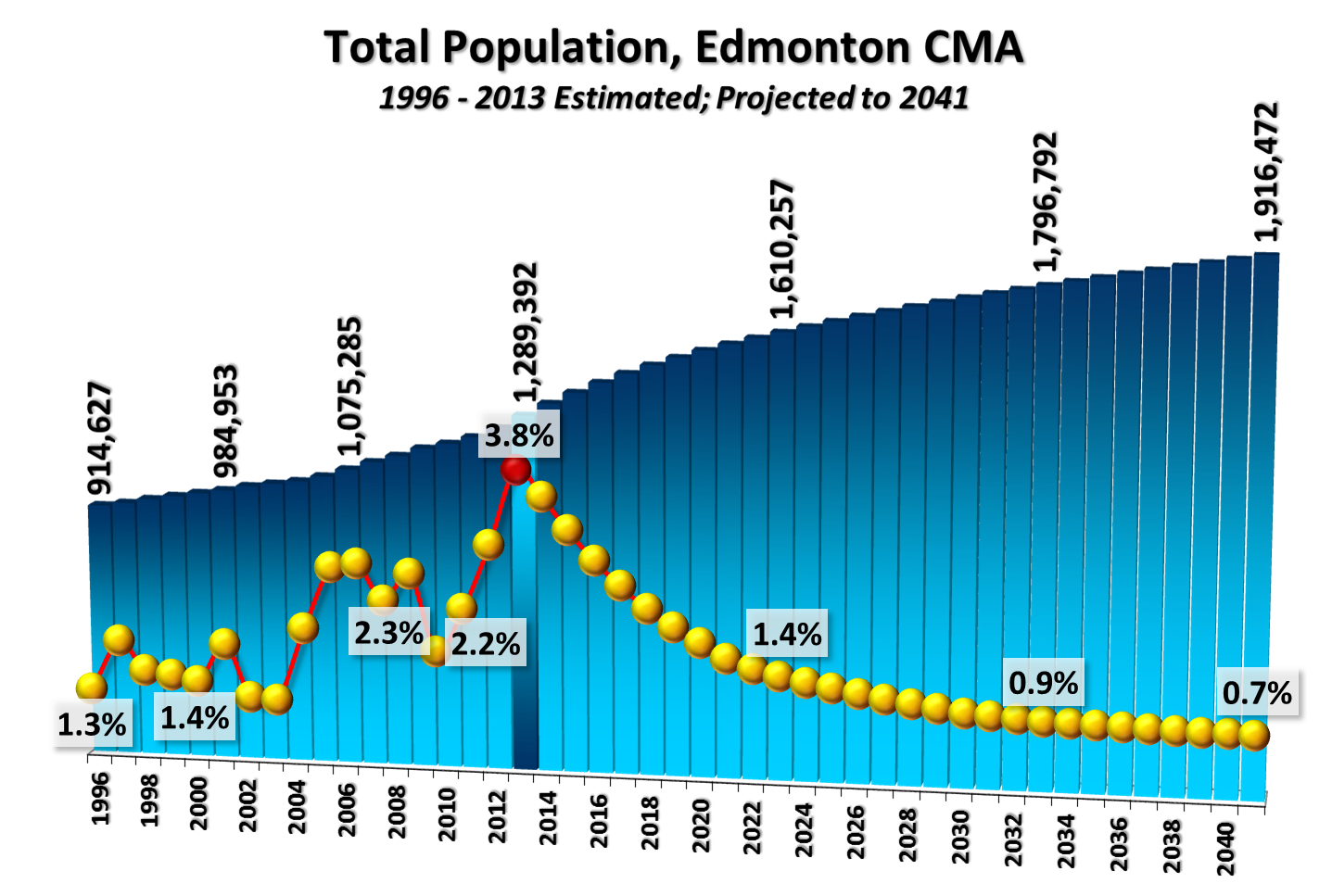

The Edmonton CMA’s population grew by 41 percent between 1996 and 2013, going from 914,627 to 1.29 million residents as an additional 375,000 people were added to the population. Considered on an annual basis, growth was relatively modest between 1996 and 2005 (ranging between 1.2 and 1.8 percent annually. Following this period—and with the exception of the slower growth seen in 2010 (1.7 percent)— the 2006 to 2013 period saw the region grow at a faster pace than over the preceding decade. Since 2010, the region’s annual population growth rate has increased steadily to reach 3.8 percent in the most recent year, the most robust year-over-year growth seen in the Edmonton CMA in the past three decades.

Looking forward, the Edmonton CMA’s population is projected to grow from its current 1.29 million residents to 1.64 million by 2023, 1.86 million by 2033, and surpassing the two million-person mark by 2041. As with the Calgary CMA (and all other Canadian CMAs), annual population growth in Edmonton will slow in response to both the moderating of migration and the general demographic shift of the region’s population into the older age groups. By the mid-2020s annual population growth is expected to be in the range of 1.5 percent, falling to below one percent per year by 2041.

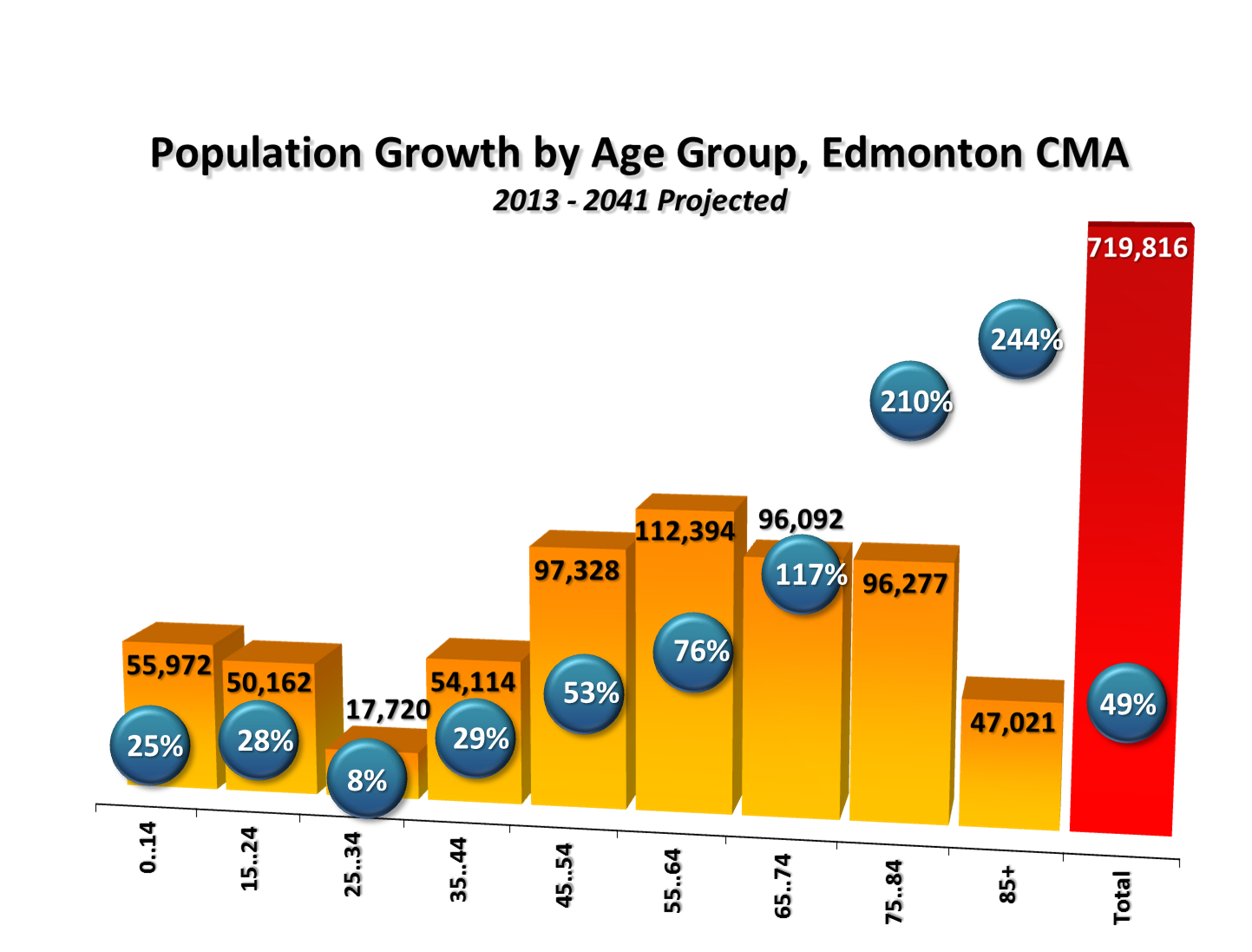

The age composition of the Edmonton CMA’s population would shift over time as the region grows, with the greatest relative increases being in the older age groups. All groups aged 45 and older would grow faster than the CMA average, accounting for 66 percent of projected growth to 2041. Thus, the 45-plus population would comprise almost half (48 percent) of the region’s population by 2041, up from 37 percent today.

As is the case with most communities in Canada, the aging of the region’s current population will largely frame tomorrow’s demographic context: given current life expectancies, 88 percent of Edmonton’s 2013 residents are expected to be alive in 2033 (and potentially living somewhere within the region), while 79 percent would still be alive by 2041.

Housing Occupancy Demand by Structure Type

Census and National Household Survey data allow housing occupancy lifecycle patterns to be considered by major structure type for the Edmonton CMA.

The proportion of Edmonton’s residents that maintain a household in ground oriented housing rises through emerging adulthood and family formation, plateaus through middle age, and then declines in the oldest age groups as other types of housing become increasingly attractive. In contrast, apartment rates increase in the younger age groups as youths move out from their parents’ homes, but then decline through the family formation years, before rising again among the older age groups.

More specifically, both ground oriented and apartment maintainer rates grow through successive age groups until the ages of 25 to 29, after which point ground oriented rates increase further to 35 percent in the 30 to 34 group while apartment rates fall from their peak of 19 percent to 15 percent for the 30 to 34 group. Ground oriented rates continue to climb through the prime child-rearing ages—reaching 49 percent for those aged 60 to 64—before beginning to decline for the oldest age groups, falling to 30 percent for those aged 85-plus. Apartment rates are at their lowest (of between nine and ten percent) for people in their 40s, 50s and 60s. Apartment rates begin to rise through the older age groups, increasing to 17 percent for those aged 80 to 84, before declining slightly to 15 percent for those aged 85-plus.

Combining trends in the lifecycle patterns of household maintainer rates with the pattern of demographic change projected for the Edmonton CMA between 2013 and 2041 would see total household occupancy demand grow by 300,386 units over the next 28 years. High maintainer rates among the rapidly-growing older age groups would see total housing occupancy demand outpace population growth: more specifically, 49 percent growth in total population would generate a 59 percent increase in total housing occupancy demand in the region between 2013 and 2041.

The additional demand is expected to be primarily ground oriented, with 225,704 net new units required to house the region’s growing and changing population, versus 74,682 net new apartments. The faster relative growth, on the other hand, would be slightly weighted towards the more compact side of the market, with apartment occupancy demand growing by 60 percent, versus 59 percent for ground oriented housing.

Housing Occupancy Demand by Tenure Type

Accompanying the age-related pattern of housing occupancy for dwelling structure types is a distinct tenure-based lifecycle pattern to maintaining a household. This lifecycle pattern corresponds with major life milestones, from living in the familial home while attending school, to moving out to enter the labour force and potentially beginning a family, to up-sizing as one ages through middle stages of a working career and raising a family.

In the Edmonton CMA, owned maintainer rates increase significantly through the family formation and family rearing stages of the lifecycle, going from a low of only 0.4 percent of people in the 15 to 19 age group owning their home to a peak of 53 percent for those aged 75 to 79. Owned maintainer rates then drop off rapidly, falling to 49 percent and 34 percent for the 80 to 84 and 85-plus age groups, respectively. Declining owned maintainer rates in the older age groups is consistent with the transition that some people make away from owned accommodation altogether, with some moving in with their children, others moving to collective care facilities, and some selling their home and moving into rental housing.

With respect to the lifecycle pattern of rental maintainer rates, there is a significant increase through the post-secondary/labour force entry and early career/family-formation stages, with rental maintainer rates going from two percent in the 15 to 19 group to 22 percent in the 25 to 29 segment. Rates for this tenure type then decline to a low of eight percent for the 65 to 69 age group. The uptick in rented maintainer rates in the 70-plus age group suggest some people decide to transition from owning to renting in the latter stages of the lifecycle.

The additional demand for owned units in the Edmonton CMA over the coming 28 years would outnumber that for rented dwellings, both in relative and in absolute terms. More specifically, the demand for owned dwellings is projected to increase from 359,861 units in 2013 to 638,738 by 2041; thus, the demand for owned housing is projected to grow by 278,877 units, or 77 percent. In comparison, the demand for rented units is projected to grow from 145,586 units in 2013 to 167,094 by 2041, as an additional 21,508 rented units would be required to house the Edmonton CMA’s residents over the coming 28 years (a 15 percent increase).

Click here to download a PDF version of a summary for Canada and selected CMAs, including this one.

Click here to download a PDF version of our full report.

© 2014 Urban Futures