The Future of Housing Occupancy: Calgary CMA

Demographic Growth & Change

Over the past 17 years, the Calgary CMA has added more than half a million residents to its population, growing from 859,722 people in 1996 to 1.36 million in 2013. During this period, annual variations in the rate of regional population growth have generally been consistent with provincial trends, with the late-1990s being characterized by relatively robust population growth (upwards of 3.5 percent), followed by a slowing in the early-2000s (into the two percent per year range), and then another expansion though the balance of the 2000s. As with most other CMAs in Canada, growth slowed following the 2009 recession, with rates moving back towards 1.8 percent annually. Having recovered from the effects of the recession, Calgary’s annual rate of population growth peaked at 4.3 percent in 2013, the highest rate among the major Canadian CMAs.

Looking forward, the Calgary CMA’s population is projected to continue to grow, albeit at a slower annual rate than has been seen historically. More specifically, the coming 28 years would see the Calgary region welcome over three-quarters of a million new residents, growing from its current 1.36 million people to 2.16 million by 2041. In annual terms, population growth would slow towards 1.6 percent through the mid-2020s, before entering a period of even slower growth that would see rates fall into the one percent range by 2041. This pattern of slowing growth reflects a moderation of migration levels from their current historical highs, as well as the aging of the existing population both into the higher mortality stages of the lifecycle and out of the prime childbearing ages.

With respect to changes in the composition of the region’s population, the greatest relative growth will be seen through the older age groups. Each of the 55-plus segments is projected to grow at a faster rate than the population as a whole, while the under-55 groups will grow more slowly. Significant and rapid growth of the older age groups would see those aged 55 and older, who comprised 21 percent of the region’s population in 2013, grow to 34 percent of the Calgary CMA’s population by 2041.

While the process of aging will characterize Calgary’s future population, long and increasing life expectancies would see 90 percent of Calgary’s current residents still alive and potentially living in the region in 2033, while 81 percent of these residents would still be around by 2041.

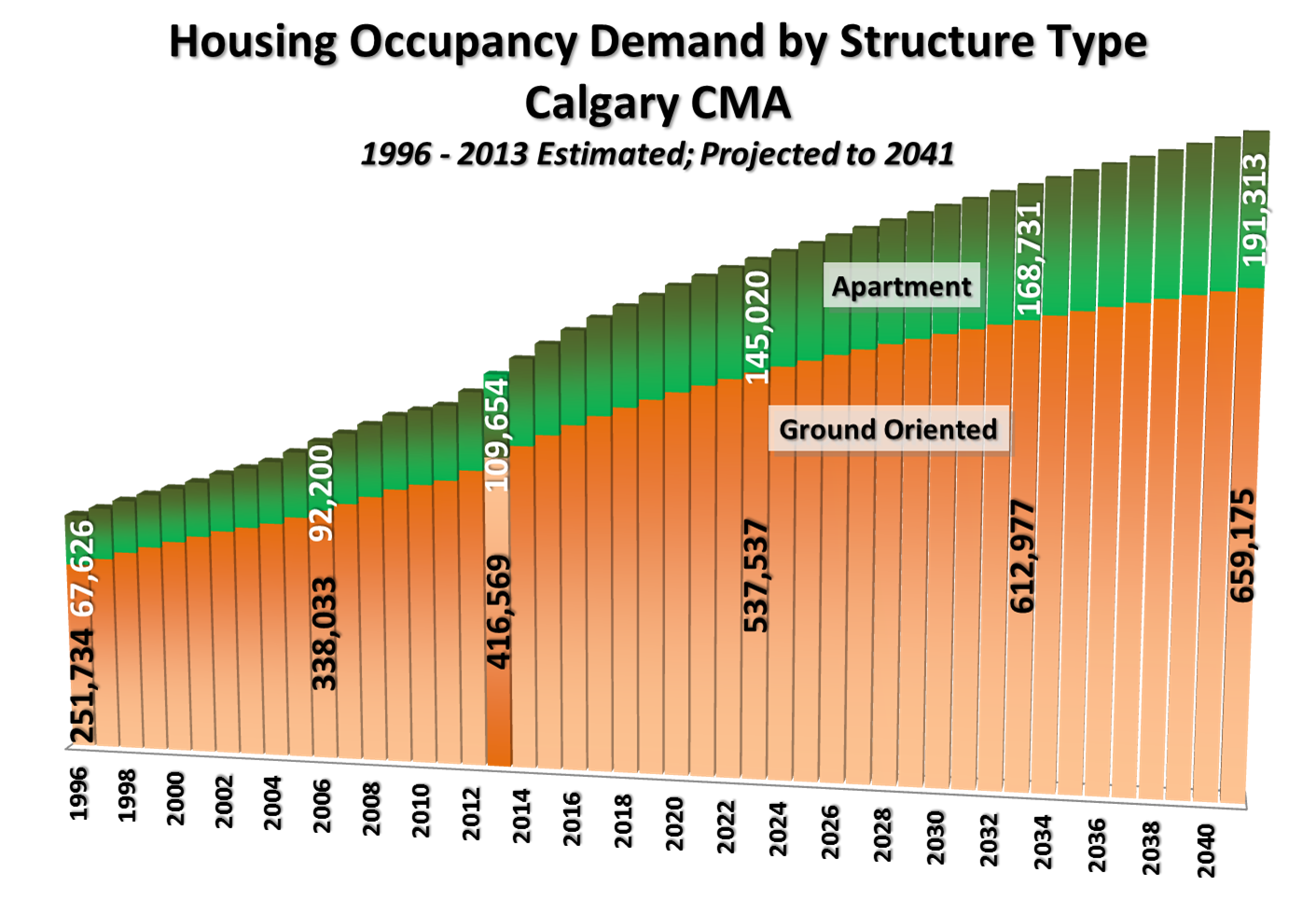

Housing Occupancy Demand by Structure Type

Using data from the Census and National Household Survey, the distinct lifecycle pattern of housing occupancy in the Calgary CMA can be considered for both ground oriented and apartment dwellings.

Calgary is unique among Canada’s major CMAs in having maintainer rates for ground oriented units that exceed apartments in all age groups. Ground oriented maintainer rates rise significantly through the family formation and rearing stages of the lifecycle where they peak at 51 percent of those aged 50 to 59 maintaining a household in a ground oriented unit. Rates then decline through the empty nester stages of the lifecycle, falling toward 30 percent of those aged 85 and older maintaining a ground oriented dwelling.

Apartment maintainer rates also increase significantly through the younger stages of the lifecycle, peaking at 17 percent of those aged 25 to 29. Rates decline from this point on, moving into the seven to nine percent range until the age of 70. In each of the successively older 70-plus age groups apartment maintainer rates grow, reaching 19 percent in the 80 to 84 age group. Apartment rates then decline marginally, to 16 percent, for the oldest age group as people either transition into collective and institutional types of accommodation or move in with relatives.

Combining trends in the lifecycle patterns of household maintainer rates in the Calgary CMA with the pattern of demographic growth and change expected for the 2013 to 2041 period would see private household occupancy demand grow by 324,265 units, or 61 percent. High maintainer rates among the 55-plus age groups, combined with rapid growth of these older segments of the population, will result in total housing occupancy demand growing faster than the region’s population: 51 percent growth in total population would generate a 62 percent increase in total housing occupancy demand in the Calgary CMA over the course of the projection period.

Changing demographics will also impact the types of housing being demanded in the region. The additional demand for ground oriented housing would outpace that for apartments, with 242,606 net new ground oriented units being required to accommodate projected population growth and change, versus only 81,659 net new apartments. In relative terms, apartment growth would exceed that of ground oriented housing at 74 percent versus 58 percent over the course of the projection period.

Housing Occupancy Demand by Tenure Type

The distinct lifecycle pattern of household maintainer rates associated with dwelling structure type is also seen when rates are considered on the basis of tenure. As in most Canadian CMAs, owned maintainer rates in the Calgary CMA increase rapidly through the family formation and family rearing stages of the lifecycle, going from a low of only one percent of people in the 15 to 19 age group who own a dwelling, to a range of between 48 and 51 percent of those between the ages of 50 and 84 owning their home. Owned maintainer rates then decline to 38 percent for the 85-plus segment of the population, as people transition into other living arrangements—be it moving in with their children, moving into collective care facilities, or selling their home and moving into private rental accommodation.

There is also a distinct lifecycle pattern to rental maintainer rates, with substantial increases through the post-secondary/labour force entry and early career/family-formation stages of life, where rental maintainer rates go from one percent (in the 15 to 19 age group) to a peak of 20 percent (in the 25 to 29 segment). Rates for this tenure type then decline to a low of eight percent for those aged 65 to 69, while slight increases in rented maintainer rates are seen in the 75 to 84 age group, suggesting that some people do make the transition from owning to renting through the latter stages of the lifecycle.

Trends in these lifecycle patterns, combined with changes in the CMA’s population over time, would see the net additional demand for owned units outpace that for rented dwellings, both in relative and absolute terms. More specifically, the owned segment of Calgary’s market is projected to grow from 390,711 units in 2013 to 683,096 by 2041, meaning that a total of 292,385 net new units would have to be created in order to accommodate projected occupancy demand. Owner-occupancy demand in the CMA would therefore increase by 75 percent over the course of the projection period.

Given the strong predominance of owned housing in the region, the future demand for rental units is projected to increase more slowly, from 135,512 units in 2013 to 167,392 by 2041. The additional 31,880 rented units required to house the region’s residents over the coming 28 years would see the region’s rental stock expand by 24 percent by 2041.

Click here to download a PDF version of a summary for Canada and selected CMAs, including this one.

Click here to download a PDF version of our full report.

© 2014 Urban Futures