Averages & Anecdotes: Trends in Home Ownership in Canada & Greater Vancouver

Andrew Ramlo & Michael Grimsrud

The Urban Futures Institute

Home ownership in Canada continues to be a hot topic in the press, at the office water cooler, and around the dinner table, particularly in regards to the ability of the younger set to become home owners. Nowhere are the discussions more prevalent than here in the Greater Vancouver region.

Home ownership rates can be calculated using a host of different methods and data sources. The most common approach is to divide the number of owned dwelling units by the total housing stock, typically using Statistics Canada’s Census and National Household Survey (NHS) counts. In addition to the Census and NHS allowing Canada’s housing stock to be examined by tenure (that is, owned versus rented), they allow other dimensions to be considered as well, including the structural type of dwelling (ground oriented and apartment) and the age of the primary household maintainer (the person who is primarily responsible for financially supporting the household).

The Census and NHS data show a strong lifecycle pattern to home ownership. From low ownership rates for household maintainers under the age of 25 population (yes, the kids are still living at home with 42 percent of those between the ages of 20 and 29 still in the parental home), ownership rates increase with age through to the early-60s, after which point they begin a slow decline into the very oldest age groups, reflecting a transition away from home ownership and/or from being a primary household maintainer (Figure 1).

The 2006 Census and 2011 NHS data show that there was little change in Canada’s total home ownership rate from 2006 to 2011, with 69 percent of households in Canada owning their residences in both years. That said, change did characterize most age groups, with the very youngest and oldest ones experiencing the most significant shifts.

The most dramatic of these increases was in the youngest household maintainers (those aged 15 to 19), as ownership rates increased from 20 to 25 percent between 2006 and 2011, a 24 percent lift. Noteworthy increases were also seen in the 20 to 24 and 25 to 29 age groups, to the tune of 11 percent and five percent, respectively.

Households maintained by folks between the ages of 30 and 34 were also more likely to be owned in 2011 than in 2006, although the increase for this group was more modest (from 59 to 60 percent) than for their younger counterparts. Increasing ownership rates also characterized Canada’s seniors, with maintainers aged 85 and better seeing the greatest relative increase among the country’s older set, at 12 percent. Home ownership rates also increased the 80 to 84 group (from 68 to 70 percent), a trend driven in part by increasing disability-free life expectancies and a continued narrowing in the gap between male and female life expectancies.

So while newspapers grumble, co-workers groan, and families grouse about the challenges faced by younger generations in becoming home owners in an increasingly expensive housing market, ownership rates for the market-entry slice of Canada’s households actually increased between the 2006 and 2011. In fact, if we look back to earlier Census counts we see that these younger groups have seen increasing ownership rates over longer periods of time. This has been driven by a host of factors, ranging from the marked decline in mortgage interest rates that have characterized the Canadian market since the early-1980s to the loosening of mortgage lending parameters and the introduction of new lending programs (it was only in 1972 that the rules were changed so that the income of a female spouse could be used to qualify for a mortgage in Canada).

The same strong lifecycle pattern to home ownership that is seen Canada-wide is evident in Greater Vancouver (or the GVRD), albeit at slightly lower rates among the late-20s to 50s age groups, and at slightly higher rates for the 70-plus groups (Figure 2). As at the national level, what amounted to only marginal change in the region’s total ownership rate between 2006 and 2011 masked significant growth among those under 30 and those over 80.

Interestingly, while generally moving in the same direction as Canada, the region’s age-specific increases were more significant than those seen at the national level. For example, the largest relative increase was for household maintainers between 15 and 19, which saw a 31 percent increase in its ownership rate between 2006 and 2011 (versus 24 percent Canada-wide). The GVRD’s 20 to 24 year old household maintainers saw its ownership rate increase from 21 to 25 percent, equivalent to a 19 percent rise (versus 12 percent nationally). Interestingly, the 30 to 34 group’s one percent decline in its home ownership rate in the region contrasted a one percent increase in this segment’s rate nationally.

As at the national level, the Greater Vancouver Region’s younger household maintainers were more likely to be home owners when they entered housing market in 2011 than their counterparts in previous years. Again, if we look back to older Census counts we see the trend towards increasing ownership rates for households maintained by the younger age groups has characterized the GVRD back to the early-1980s. In fact, the ownership rate for the under-25 group in 1981 was less than half what it is today, at 12 percent versus 26 percent.

Owning on the ground

While the primary focus of the home ownership discussion tends to be on the ability of the younger generations to enter the market, the subtext to these discussions is the ability of younger generations to own “family-style” housing, otherwise characterized as traditional, ground oriented forms of accommodation. So what has happened to the pattern of owning a bit of grass for the Mr. Turtle Pool and sandbox?

Before we consider the change, it is important to note that home ownership rates for all ground oriented accommodation (from a single detached to a row house or mobile home) follow a similar lifecycle pattern to all dwellings, but are substantially higher than when all dwelling types are pooled together (Figure 3). At 86 percent, the 2011 total ground oriented ownership rate was 24 percent higher than that of all structural types, indicating that the apartment segment of the market is more heavily weighted towards rental tenure than owned (more on the apartment market below).

Canada’s total ground oriented ownership rate held steady at 86 percent between 2006 and 2011. Marginal declines of one percent or less among the 35 to 69 and 75 to 79 age groups were again balanced by gains in the younger groups. Youth household maintainer ownership rates for ground oriented dwellings grew between 2006 and 2011, headlined by a 16 percent increase for those aged 15 to 19, followed by six percent for the 20 to 24 group, and two percent for the 25 to 29 group. Slight increases also characterized ground oriented households maintained by those in the 80-plus age groups.

Unlike at the national level however, Greater Vancouver’s total ground oriented ownership rate declined slightly between 2006 and 2011 (Figure 4). While many age groups experienced slight declines in ownership rates for traditional family-style housing over this period, all household maintainers under the age of 30 saw their rate of home ownership increase. Further to this, ownership rates for the GVRD’s youngest ground oriented maintainers grew more quickly than for their national counterparts: ground oriented ownership rates for 15 to 19 year old maintainers in Greater Vancouver rose by 23 percent (versus 16 percent Canada-wide), while those for the 20 to 24 group rose by 13 percent (versus six percent nationally). Rates for the 25 to 29 segment increased by two percent both locally and nationally.

Owning up in the air

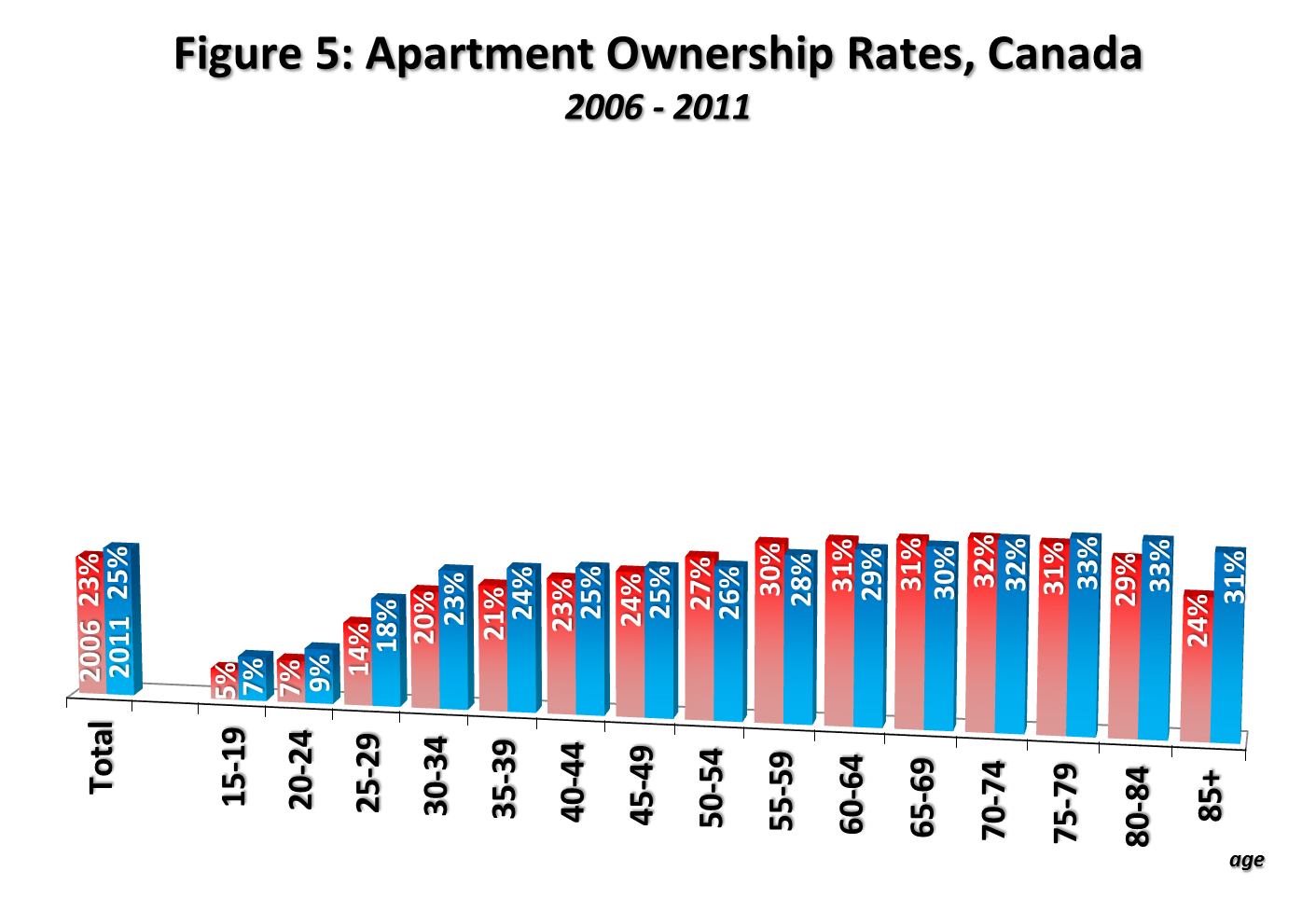

Across Canada, ownership rates within the apartment segment of the market tend to be much lower than for ground oriented dwellings. More specifically, Canada’s total apartment ownership rate was 25 percent in 2011, versus 69 percent for all dwelling types and 86 percent for ground oriented units. Although ownership rates for every age group were at least 37 percentage points lower than those for their ground oriented counterparts, Canadian apartment ownership rates still follow a general lifecycle pattern, just at much lower levels when compared to ground oriented rates (Figure 5).

Overall, Canadian apartment ownership rates rose by seven percent between 2006 and 2011, or by two percentage points, from 23 to 25 percent. Ownership rates increased for apartment maintainers in most age groups, the most substantial increases again characterizing the younger age groups: the 15 to 19 group saw a 44 percent increase and the 20 to 29 group a 30 percent increase between 2006 and 2011.

It is interesting to note that while still lower than ground oriented ownership rates, apartment ownership rates are significantly higher in the GVRD than those seen nationally. More specifically, the lifecycle pattern of apartment ownership rates in the GVRD resembles that of Canada, but with age specific rates landing somewhere between the GVRD’s ground oriented rates and Canada’s apartment rates (Figure 6). Put slightly differently, the gap between apartment and ground oriented ownership rates in the GVRD is markedly narrower than at the national level.

As with Canada as whole, GVRD apartment ownership rates have been on the rise, growing by six percent between 2006 and 2011 (from 41 to 44 percent). This growth was less concentrated in the younger age groups than at the national level, as every group under the age of 45 increased more modestly in the GVRD. For example, while the 15 to 19 group of apartment maintainers saw a 40 percent increase in ownership rates in Greater Vancouver, they experienced a 44 percent bump nationally; similarly, the 20 to 25 group had a 21 percent increase locally compared to a 30 percent increase nationally, and the 12 percent increase for the 25 to 29 group was eclipsed by a 30 percent increase nationally.

The pattern of significantly higher apartment ownership rates for all age groups in Greater Vancouver when compared to Canada as a whole reflects a historical shift in housing culture and form towards more compact living and dwellings, a trend that is now also beginning to characterize the rest of Canada’s housing market. Furthermore, the continued increases in ownership rates for the youngest age groups of apartment maintainers reflect the growing importance of the owned apartment market as an entry point for first-time purchasers.

Strategic Considerations

While home ownership is not a life-long objective for everyone (almost one-third of Canadians rent), the headlines that portray the current younger generation as being more challenged than previous younger generations to enter the owned side of the housing market are balanced by the data that show continued increases in home ownership rates among young age groups of household maintainers both locally and nationally. That said, the most recent data show that growth in ownership rates for the younger set fell below that seen in previous Census periods, especially for the early-30s group.

From one perspective, a slowing in the growth of youth home ownership rates supports the notion that it is getting harder for the newest generation of home owners to enter the market. From another perspective, however, growth in youth home ownership rates between 2006 and 2011, while slower than in previous periods, could also be interpreted as being comparatively strong when considered against overall ownership rates that were at best static both locally and nationally.

While youth home ownership has been the primary focus of this piece, the dramatic rate increase at the other end of the age spectrum clearly merits mention and future study, as the oldest segment of household maintainers demonstrated substantial increases between 2006 and 2011 both locally and nationally. These increases were overwhelmingly within the apartment segment, again reflecting a continued shift in housing occupancy (and housing culture) towards owned apartments through this latter stage of the lifecycle.